The slum youngster is ready to contend in the work market place for a excellent job and live a far better everyday living. Each individual yr the enrollment on this type of training keep on to maximize.

On line Christian Schools give pupils an chance to research by the pretty cozy conditions. When I generate an essay, I figured out a long time in the past to break up my essay into parts. On the internet schooling is presented and can be attained by means of the medium of World wide web. These variety of degree courses are perfect for functioning older people with hectic schedules. This key phrase stuffing really defeats the goal guiding write-up marketing since the notion guiding key phrases in the posting is to draw website visitors to your website. There will be publications that go over a array of subjects and data, all relying on what you are seeking for.

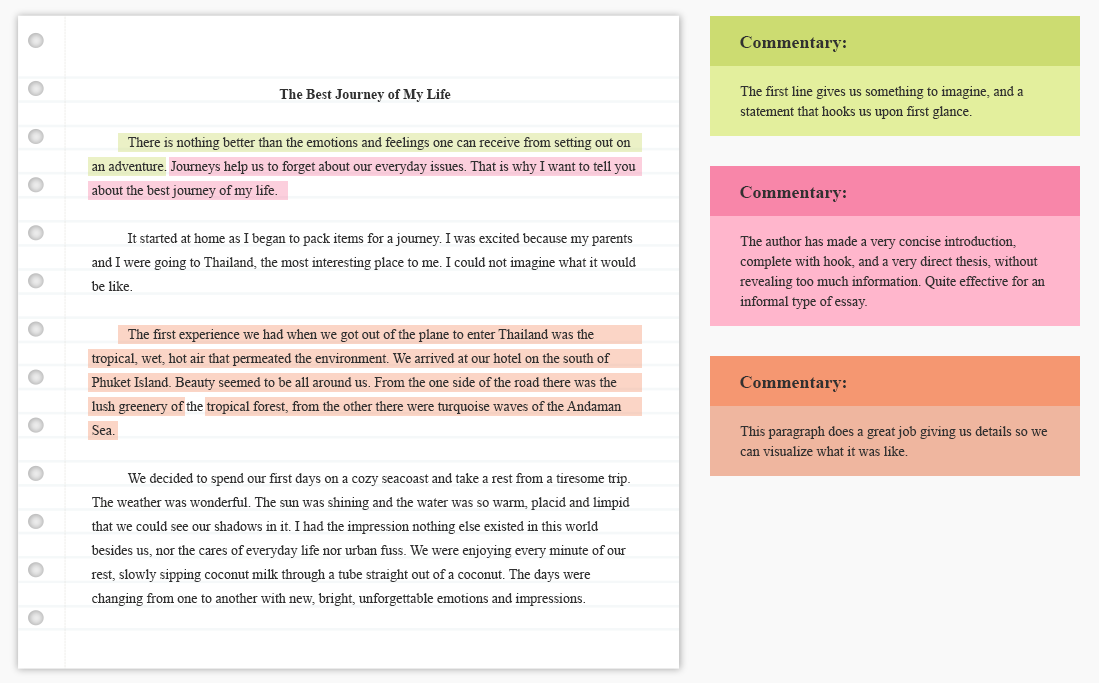

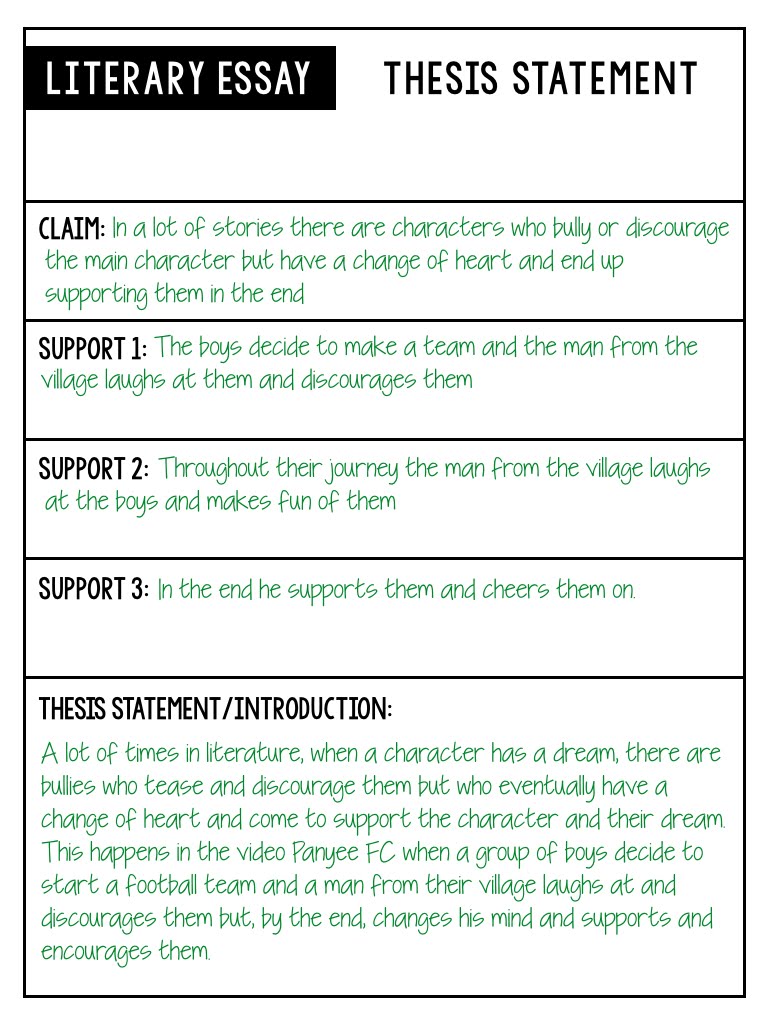

The 5-paragraph format is a tried out and true way to approach for an essay. Attempting to force it can limit your creative imagination and obscure insights, inspiration and clean means of searching at factors.

Research Paper Writing Help Online Reddit

We must also halt producing false comparisons amongst a dynamic, but mature procedure and more youthful a lot less dynamic methods. Guide To Continuing EducationrnThe 1st draft is possibly the worst draft and you will need to rewrite the draft a number of occasions to make it better. There are a lot of Christian Faculties which present students with the online diploma courses. He considered that he experienced anything to are living for and reached into the deep UCL (University College London) their explanation Photojournalism sources of his intellect by imagining outside the box. rn

And, nonetheless, we slave away at a further endeavor mainly because we like it. The mistake a lot University of California, Los Angeles (UCLA) Can I be expelled for inquiring about essay writing service on Craigslist? reddit Spanish of men and women make when writing is to assume that crafting consists only of – perfectly, writing! Sometimes we arrive to the table without the need of a system in brain, but we feel like we want to produce. In the exact same way that you experienced the pupils edit and revise their peer’s operate, let them to respectfully make reviews about what they liked or did not like about the piece of writing. It destroys creativeness and helps prevent one particular from using this rich resource of the intellect. The base line is to formulate a established of targets for your crafting and permit your own character to present by. Are you looking for vocation chances in instruction? This is a remarkably essential essay writing idea – whichever you do, make sure you really don’t plagiarise a further author’s perform.

It also goes into information about laws, proceedings, and so on. It is achievable that an unique attains a school degree without real schooling.

On the other hand there undoubtedly are some tips that you can use to prepare your self to rating massive on your Praxis II essay area. Some folks do appear to have an inborn knack for expressing on their own in words and phrases, but just about every person else enhances via apply, feed-back and instruction. Discovering new phrases is superior, but it can be even much better to discover to make much better use of the tens of 1000’s of words you now know. Honor your fearless crafting inclinations and process by recording whatever words and phrases want to emerge, no subject how mad or “in contrast to” you they seem. I do however operate full time so I will not put as well substantially strain on producing a different income by way of the writing but, it is surely good to know that the opton to do so is there. It also bolstered my personal commitment to persist and be fearless in my writing when I wrote a horrid 1st draft of a chapter for my memoir. As technology persist to comprise, a new way of discovering is staying discern to scatter the better education and learning, the so named-length training.

The moment you are done, expend the future 20 minutes speed composing. Audio experienced and make confident that you do not free out on the educational facet of your essay. Is it legitimate that the modern-day working day mom and dad and these of the before instances considered about training in two distinct approaches? This is mainly because the programs will involve additional of penned text in the inquiring and answering of inquiries.